In the Medium-Term Management Plan 2027 published on November 6, 2024, a revision was made to the policy on shareholder returns for the plan period, as follows.

・ With the aim of more actively paying dividends to shareholders, we will increase the consolidated dividend payout ratio to 30–40% (from 25–35% in the past) and strive for dividend growth through medium- to long-term profit growth;

・ For ordinary dividend, “DOE of 4.0%” will be used as the new target for stable and continuous dividend payments;

・ Additional measures aligned with profit levels and capital efficiency will be flexibly implemented through special dividends and acquisition of treasury shares.

Investor RelationsInvestor Relations

Investor RelationsInvestor Relations

Distribution of Profits

Dividend Policy

Dividends per Share

(yen)

| 2022/3 | 2023/3 | 2024/3 | 2025/3 | 2026/3 | |

|---|---|---|---|---|---|

| Interim | 22.5 | 50 | 55 | 55 | 60 |

| Year-end | 37.5 | 60 | 55 | 55 | 70(Plan) |

| Annual | 60 | 110 | 110 | 110 | 130(Plan) |

*The Company conducted a two-for-one stock split of its common stock effective October 1, 2024. The amounts indicated above related to dividend paid for the periods prior to October 1, 2024, are adjusted for the said stock split.

Treasury Stock

KAGA ELECTRONICS CO., LTD. (the “Company”) hereby announces that, at today's Board of Directors meeting, it has resolved to acquire its treasury shares to establish a specific method of acquiring treasury shares, pursuant to the Company’s Articles of Incorporation complying with Article 459, Paragraph 1, of the Companies Act.

1.Reason for acquisition of treasury shares

The capital policy set out in the “Medium-Term Management Plan 2027 for fiscal years 2025-2027” (the “Medium-Term Plan”) announced in November 2024, outlines a basic cash allocation policy to actively allocate cash to growth investments and shareholder returns, and to apply surplus funds to shareholder returns. The plan also establishes a basic shareholder return policy, setting a consolidated dividend payout ratio and DOE as targets for proactively and sustainably paying dividends and flexibly acquiring treasury shares according to profit levels and capital efficiency.

Regarding the above, the Company has been informed by our shareholders—MUFG Bank, Ltd., Mizuho Bank, Ltd., Sumitomo Mitsui Banking Corporation, and The Hokuriku Bank, Ltd.—that they intend to sell a portion or all of their holdings of the Company's common shares, in order to reduce their strategic shareholdings in accordance with the requirements of the corporate governance code.

Shareholder rank |

Name |

Number of shares held |

Percentage of total shares issued* |

5th place |

MUFG Bank, Ltd. | 2,275,268 |

4.3% |

6th place |

Mizuho Bank, Ltd. | 1,900,668 |

3.6% |

20st place |

Sumitomo Mitsui Banking Corporation | 441,810 |

0.8% |

31nd place |

THE HOKURIKU BANK, LTD. | 299,870 |

0.6% |

Note: Percentage of the total number of issued shares (excluding treasury shares)

The Company believes that such a decrease in the percentage of its shares held by these cross-shareholders will contribute to enhancing corporate value from the perspective of increasing discipline in corporate management for the Company. Additionally, after comprehensively considering the potential impact on our stock price if a certain number of shares were sold intermittently within a given timeframe, we determined that repurchasing these shares via the Tokyo Stock Exchange's off-auction treasury share repurchase trading system (ToSTNeT-3) would be appropriate. Thus, we have decided to repurchase up to a maximum of 4.92 million shares, or 15.0 billion yen, of our treasury shares. To dispel concerns about the future dilution of the Company's shares, all repurchased treasury shares will be canceled.

This initiative, as part of the capital policy aimed at capital efficiency and proactive shareholder returns as outlined in the Medium-Term Plan of the Company, will be undertaken to improve capital efficiency, including ROE, and is expected to lead to an increase in earnings per share (EPS) for existing shareholders, among other factors. We plan to appropriate the entire amount required for this treasury share repurchase from our own funds accumulated during the previous Medium-Term Plan period. As of March 31, 2025, the Company's net cash on a consolidated basis is 46.6 billion yen, and even after this repurchase, the Company's liquidity on hand is secured. Furthermore, a certain amount of cash is expected to be generated during the current Medium-Term Plan period. Going forward, we will continue to allocate funds actively to growth investments and shareholder returns, while maintaining the Company's financial soundness and security,

Furthermore, as stated in the “Notice Regarding Upward Revision to Forecasts for Full-Year Earnings and Divisions (Dividend Increase) and Recording of Extraordinary Income (Gain on Bargain Purchase)” dated today, accompanying the conclusion of the tender offer for the common shares of Kyoei Sangyo Co., Ltd. on July 11 of this year, we have revised the earnings forecasts for the fiscal year ending March 31, 2026, and have also announced an upward revision of the dividend forecasts.

2.Method of acquisition

The Company will entrust the repurchase at the closing price of 2,938 yen on August 7, 2025, through the off-auction treasury share repurchase trading system (ToSTNeT-3) on the Tokyo Stock Exchange at 8:45 a.m. on August 8, 2025. Please note that this repurchase order applies only to the trading during the period of time above mentioned and no changes will be made to other trading systems or hours.

3.Details of acquisition

| (1) Class of shares to be acquired | Common shares of the Company |

| (2) Total number of shares to be acquired | Up to 4,920,000 shares Ratio to the total number of shares outstanding (excluding treasury shares): 9.4% |

| (3) Aggregate acquisition amount | Up to 15.0 billion yen |

| (4) Announcement of the results | After trading at 8:45 a.m. on August 8, 2025 |

Note 1) The number of shares above will not change. Due to market trends and other factors, a portion or all of the acquisition may not be carried out.

Note 2) The shares will be repurchased through sell orders corresponding to the planned number of shares to be acquired.

Not applicable. (2)Status of acquisition upon resolution of the Board of Directors

Not applicable. (3)Matters contingent neither on resolution of general meeting of shareholders nor on resolution of the Board of Directors

Shares |

Yen |

|

Treasury shares acquired in the current fiscal year |

668 |

1,889,996 |

* The Company conducted a share split effective October 1, 2024, with each common share split into two shares. The breakdown of treasury shares acquired during the fiscal year under review was 538 shares acquired before the share split and 130 shares acquired after the share split.

Shares |

Yen |

|

| Acquired treasury shares offered to subscribers | - |

- |

| Acquired treasury shares disposed of | - |

- |

| Acquired treasury shares transferred in relation to merger, share exchange, or demerger | - |

- |

| Other (granting of restricted stock compensation) | 10,957 |

62,126,190 |

| Number of treasury shares held | 4,843,430 |

- |

Cancellation of the Treasury Shares

KAGA ELECTRONICS CO., LTD. (the “Company”) hereby announces that, at today's Board of Directors meeting, it has resolved to cancel the treasury shares under the provisions of Article 178 of the same Act.

Details of cancellation

| (1) Reason for canceling treasury shares | To dispel concerns about the dilution of per-share value associated with a future offering of treasury shares, treasury shares will be canceled. |

| (2) Class of shares to be canceled | Common shares of the Company |

| (3) Total number of shares to be canceled | 4,920,000 shares (planned) [Percentage of the total number of issued shares (excluding treasury shares) before cancellation: 9.4%] Note 3) All shares repurchased through the acquisition of treasury shares, as described above in section 3, will be canceled. |

| (4) Total number of issued shares after cancellation (excluding treasury shares) |

47,640,806 shares (planned) |

| (5) Scheduled date of cancellation | August 18, 2025 |

(Reference) Number of treasury shares as of March 31, 2025

Number of issued shares (excluding treasury shares): 52,560,806 shares

Number of treasury shares: 4,843,430 shares

Stock Split

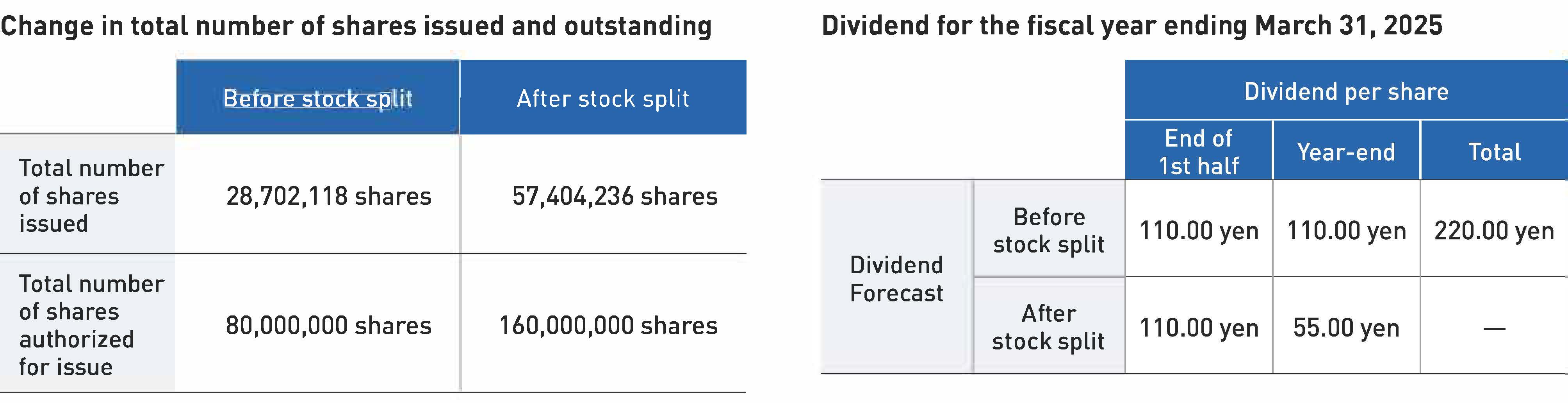

The Company executed a stock split on October 1, 2024. Each share of the Company’s common stock was split into two shares with a record date of September 30, for the purpose of creating an environment conducive to investment in the Company’s shares by lowering the amount required per investment unit, thereby improving the liquidity of Company’s shares and expanding the range of potential investors.

In connection with this stock split, the year-end dividend for the fiscal year ending March 31, 2025, has been revised to 55 yen per share. However, as this revision is due to the stock split, there is no effective change in the dividend per share from the previously announced forecast.