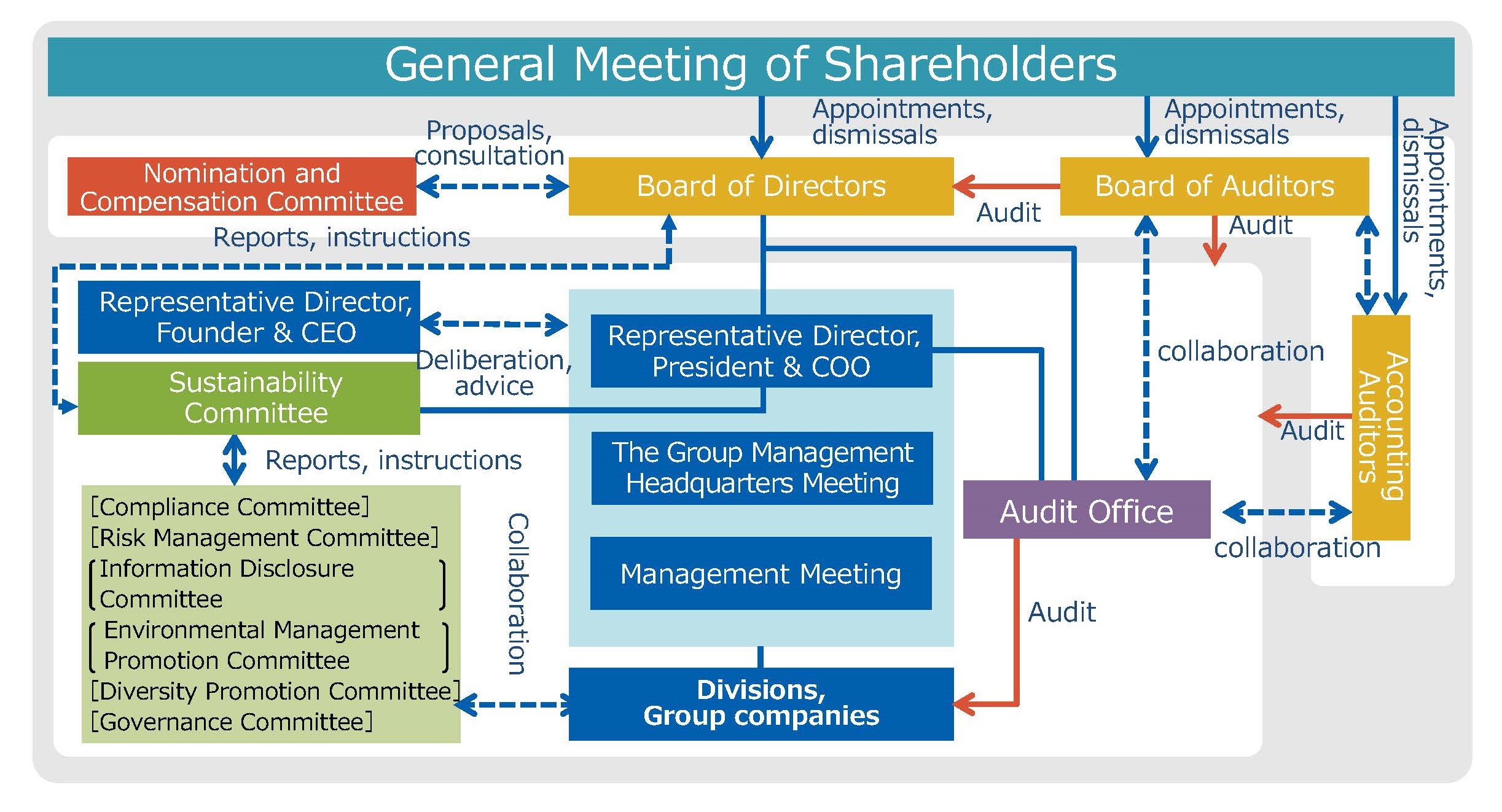

Matters relating to functions such as business execution, audits and supervision, nomination, and remuneration decisions (overview of current corporate governance systems)

(1) Board of Directors

The Board of Directors comprises 12 directors in total including 6 outside directors. In principle, the Board meets once each month and holds extraordinary meetings when necessary.

Board makes deliberates and decisions on matters specified in laws and regulations, the Articles of Incorporation, and other internal rules, reports on the status of the execution of business and other necessary information, and supervises the execution of duties by directors.

(2) Audit and Supervisory Committee

The Audit and Supervisory Committee comprises 4 members including 3 outside Audit and Supervisory Committee members. In principle, the Audit and Supervisory Committee meets once each month and holds extraordinary meetings when necessary.

(3) The Group Management Headquarters Meeting

The Company has established the Group Management Headquarters Meeting, which is convened by the Representative Director, President & COO as a body to deliberate and decide on important executive policies related to Group management. In principle, the Conference meets once each week. Also, advice is requested from the Representative Director, Founder & CEO, as necessary.

(4) Management Meeting

The Company established a Management Meeting, which is convened by the Representative Director, President & COO to coordinate Group management, confirm policies, and so on. In principle, the Council meets once each month.

(5) Nomination and Compensation Committee

Please refer to Section II: Management Decision-Making, Management Organizations for Execution and Supervision, and Status of other Corporate Governance Systems, Directors, Existence of a discretionary committee corresponding to a nominating or remuneration committee, and the Supplementary Explanation in this report.

(6) Sustainability Committee

The Sustainability Committee, chaired by the Representative Director, President & COO. Under the committee, we have set up specialized subcommittees for Compliance, Risk Management, Information Disclosure, Environmental Management Promotion, Diversity Promotion, and Governance. This management structure promotes CSR and sustainability across the Group.

(7) Audit Office

The Audit Office is under the direct authority of the Representative Director, President & COO. It works in collaboration with the Administration Headquarters, etc. to audit the validity and use of management resources, as well as the status of compliance with laws, regulations, and internal rules, in relation to all business activities, including those at Group companies. The Company is also conducting evaluations of our internal control systems in response to the enforcement of the Financial Instruments and Exchange Act.

(8) Execution of business

The allocation of duties to directors and executive officers are determined by decisions of the Board of Directors, and each carries out their duties.

(9) Audit and supervision of Director who are Audit and Supervisory Committee Members

The Company established and implements Audit Standards for Audit and Supervisory Committee members.

(10) Status of audits

Audits in the Company are planned and carried out by the 4 Audit and Supervisory Committee members.

The Company also undergoes audits by PricewaterhouseCoopers Japan LLC.

(11) Nomination and Compensation Decisions

Concerning nomination, please refer to Section I: Basic approach to corporate governance, capital structure, corporate attributes, and other basic Information, Disclosure Pursuant to the Principles of the Corporate Governance Code, Principle 3-1: Enhancement of Information Disclosures of this report.

Concerning compensation decisions, please refer to Section II: Management Decision-Making, Management Organizations for Execution and Supervision, and Status of other Corporate Governance Systems, Director Remuneration of this report.

(12) Limited Liability Agreements

The Company has entered into contracts with directors (excluding executive directors, etc.) based on the provisions of the Companies Act, Article 427, Paragraph 1 to limit their liability for damages under Article 423, Paragraph 1 of the said Act. The maximum amount of liability for damages based on this agreement shall be the amount stipulated in laws and regulations. Furthermore, this limitation of liability shall only be recognized when the execution of duties that was the cause of the liability of the director was performed in good faith and without gross negligence.

Directors

| Number of directors specified in Articles of Incorporation |

20 |

| Term of office of directors specified in Articles of Incorporation |

1 year |

| Chairperson of the board |

President |

| Number of directors |

12 |

| Appointment of outside directors |

Outside directors are appointed |

| Number of outside directors |

6 |

| Number of outside directors designated as independent directors |

6 |

Audit and Supervisory Committee Member

| Whether the company has an Audit & Supervisory Committee |

Established |

| Number of Audit and Supervisory Committee Member specified in Articles of Incorporation |

4 |

| Number of Audit and Supervisory Committee Member |

4 |

Activities of Outside Directors

| Post |

Name |

Attendance (FY2025/03) |

| Director |

Susumu Miyoshi |

17/17 (100.0%) |

| Director |

Noritomo Hashimoto |

17/17 (100.0%) |

| Director |

Mamoru Yoshida |

13/13 (100.0%) |

Director Remuneration

・Basic policy

The Company's basic policy is to set the remuneration of directors at an appropriate level based on their respective responsibilities in determining the remuneration of individual directors as a remuneration system that is linked to shareholders' profits so that it can fully function as an incentive to secure and retain excellent human resources who will implement the realization of the Company's management philosophy and continuously improve corporate value. Specifically, remuneration for executive directors consists of fixed remuneration, which is paid at a fixed amount, performance-linked remuneration and stock-based remuneration, while remuneration for outside directors and director who are Audit and Supervisory Committee members, who are responsible for supervisory functions, consists of fixed remuneration only in consideration of their responsibilities. Furthermore, the content of remuneration for directors is designed to be reasonable, objective and transparent in terms of both the content of remuneration and decision-making procedures. ・Policy regarding the determination of the amount of remuneration, etc. for each individual in fixed remuneration The fixed remuneration for directors of the Company shall be fixed monthly remuneration in cash, which shall be determined in accordance with the position and responsibilities, etc., while taking into consideration the levels of other companies, the business performance of the Company, and the level of employee salaries, and reviewing the remuneration as appropriate in a comprehensive manner.

・Policy for determining the details of performance-linked remuneration, etc. and non-monetary remuneration, etc. and the method for calculating the amount or number of such remuneration

Performance-linked remuneration, etc. is monetary remuneration reflecting performance indicators in order to raise awareness of the need to improve performance for each fiscal year, and an amount calculated in accordance with the degree of achievement of the target values for operating income, ordinary income and net income attributable to owners of parent for each fiscal year is paid as a bonus at a specified time. The target performance indicators and their values are based on the profit-oriented management set forth in the Medium Term Management Plan, and will be reviewed in accordance with changes in the business environment, respecting the report of the Nomination and Compensation Committee. The amount of performance-linked remuneration is based on the consolidated business results. Non-monetary remuneration, etc. is granted at a set time after the end of the fiscal year as restricted stock compensation with a transfer restriction period of up to 20 years, which is designed to provide incentives for the sustainable enhancement of the Company's corporate value and to promote further value-sharing with shareholders through the holding of the Company's shares. The number of shares to be granted is determined in consideration of the position, responsibilities, stock price, etc., and with respect to the report of the Nomination and Compensation Committee.

・Policy on determination of the ratio of the amount of monetary remuneration, the amount of performance-linked remuneration, etc., or the amount of non-monetary remuneration, etc., to the amount of individual remuneration, etc., of directors The ratio of type of remuneration for directors (excluding outside directors and director who are Audit and Supervisory Committee members) is determined based on the report of the Nomination and Compensation Committee, taking into consideration the position, responsibilities, and trends in the remuneration levels of other companies with similar business scale as the Company.

・Matters related to the decision policy concerning the details of remuneration, etc. for individual directors Based on the delegated resolution of the Board of Directors, Representative Director, Founder & CEO and Representative Director, President & COO are delegated the authority to determine the amount of fixed remuneration for each director, the allocation of performance-linked remuneration (bonuses, etc.) based on the performance of the business for which each director is in charge, and the number of shares to be allotted to each individual in the form of restricted stock compensation.

The Board of Directors consults the Nomination and Compensation Committee on the draft and obtains its report to ensure that such authority is properly exercised by the Founder & CEO and President & COO, and the Founder & CEO and President & COO, who have received the above delegation, make decisions with respect to the content of this report.

・Matters concerning the method of decision when the decision on the details of remuneration, etc. is delegated to a director or other third party The Representative Director, Founder & CEO and Representative Director, President & COO determine the specific details of the amount of remuneration, etc. and the number of shares to be allotted to each individual based on the delegated resolution of the Board of Directors. The Board of Directors shall take measures to make decisions after consultation and reporting by the Nomination and Compensation Committee to ensure that such authority is properly exercised by the Founder & CEO and President & COO. The Founder & CEO and President & COO determine the details of individual remuneration for each director by fully respecting the advice and report of the Nomination and Compensation Committee, while taking into consideration the Company's overall performance, stock price, the role of each director, the impact of each director on the Company's performance and other circumstances. ・Matters related to the resolution of the General Meeting of Shareholders regarding the remuneration of directors and Audit and Supervisory Committee members

The maximum amount of remuneration for directors was resolved at the 57th General Meeting of Shareholders held on June 26, 2025, to be less than 1,200 million yen per year (of this amount, up to 200 million yen is for outside directors; salaries for services as employees are not included). As of the close of this General Meeting of Shareholders, the number of directors, not including the Audit and Supervisory Committee members, was 8 (including 3 outside directors).

In addition, it was resolved that the annual amount of monetary remuneration claims to be paid to directors, not including the Audit and Supervisory Committee members (excluding outside directors), for the granting of restricted shares shall be 300 million yen or less, separately from the above maximum amount of remuneration. As of the close of this General Meeting of Shareholders, the number of directors, not including the Audit and Supervisory Committee members (excluding outside directors) was 3.

It was resolved that the maximum amount of remuneration to be paid to the Audit and Supervisory Committee members shall be 100 million yen or less per year. The number of Audit and Supervisory Committee members as of the close of this General Meeting of Shareholders was 4. Furthermore, the remuneration of Audit and Supervisory Committee members is determined through consultation among said committee members.

Total amounts of remuneration, etc.

3 directors : Amount paid 679 million yen(210 million yen as fixed remuneration, 447 million yen as performance-linked remuneration, 21 million yen as restricted stock compensation)

3 outside directors : Amount paid 28 million yen

Total remuneration, etc. paid to persons who received 100 million yen or more in remuneration, etc.

Isao Tsukamoto : 319 million yen paid

RyoichiKado : 228 million yen paid

Shintaro Kakei : 131 million yen paid

Corporate Governance Organizational Diagram

Summary of Deliberations by the Board of Directors

・ Main matters deliberated in FY2024

| Medium-Term Management Plan |

Report on progress of the Medium-Term Management Plan 2024 and results, Formulation of the Medium-Term Management Plan 2027 |

| Sustainability |

Sustainability and Environmental Management Promotion Committee Activity Reports, revision of Environmental Policy. |

| Corporate officers |

Changes in corporate officers (Group-wide), remuneration, limited liability agreement with Outside Auditors, D&O insurance |

| Governance |

Evaluation of the effectiveness of the Board of Directors, transition to a company with an Audit and Supervisory Committee |

| Human resources |

Performance-linked bonuses, Report on engagement survey results, revision of retirement benefit system, revision of qualification age-limit system, promotion of active participation by senior human resources, revision of overseas allowances, rewards and punishments |

| Systems and DX |

Response to generative AI, cyberattack countermeasures

|

| Auditing |

Internal auditing annual activity report, internal audit plan, external audit fees

|

| Internal controls |

Determination of the effectiveness of internal controls, internal controls report |

| Risk Management |

Violations of laws, reporting of impropriety, credit management |

| Finance & Accounting |

Account settlement, budget, borrowing limits, dividends of surplus, financial investment, cash flow, stock split |

| Compliance |

Compliance Committee Activity Report, revision of details of authority, setup of investigation committee |

| Litigation and arbitration |

Litigation expenses |