Investor RelationsInvestor Relations

Investor RelationsInvestor Relations

Medium-Term Management Plan 2027 (FY2025-FY2027)

For Medium-Term Management Plan 2024 (hereinafter “the previous plan”), a top-down approach was used to set targets. Members of top management provided general outlines of what they wanted the Company to achieve, then broke those down and fleshed them out for each business segment.

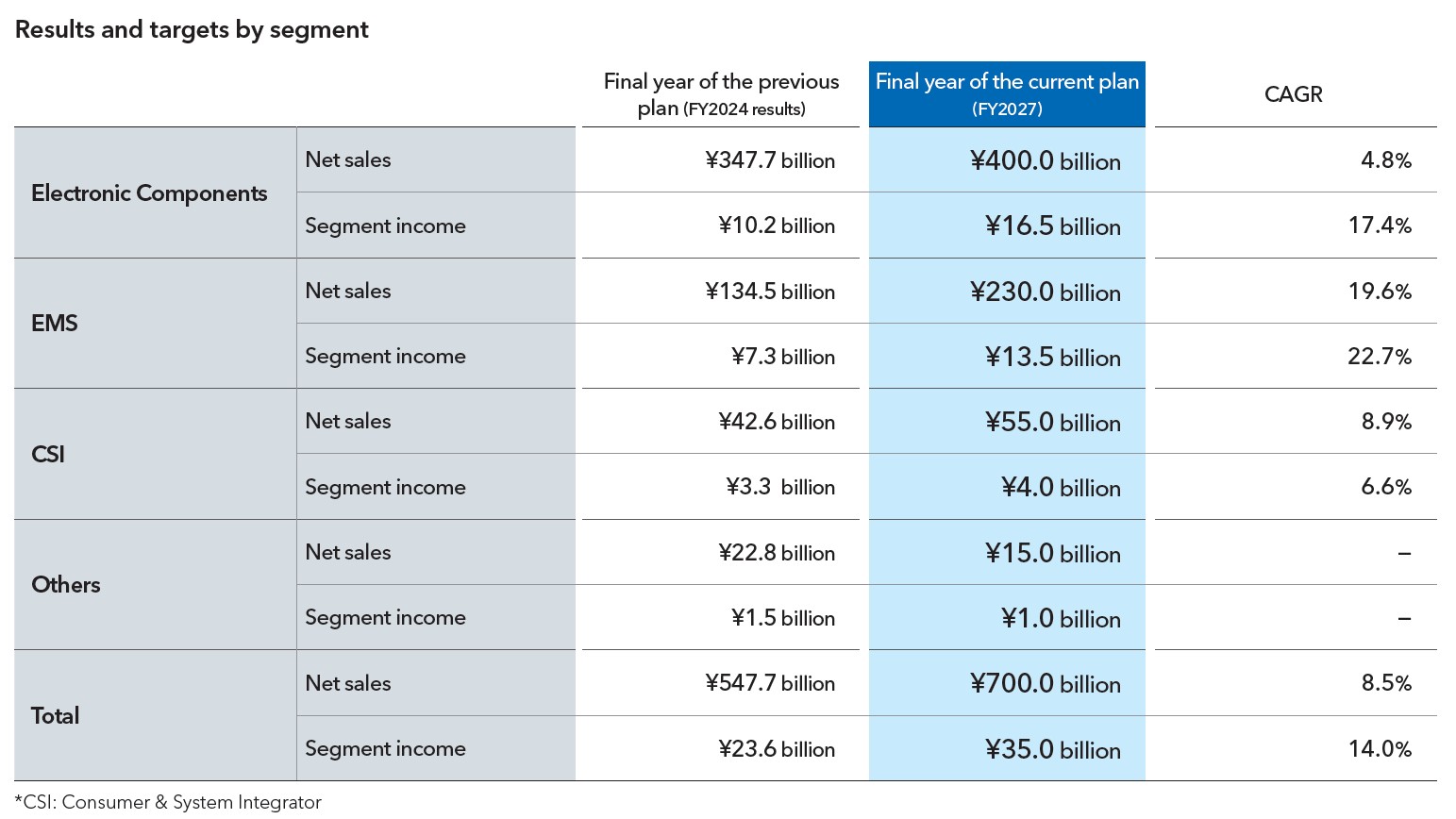

Conversely, a bottom-up approach was adopted when setting targets for Medium-Term Management 2027 (hereinafter “the current plan.” Each business division was required to create its own medium-term management plan. These were then aggregated and an organic growth target of over ¥700 billion in net sales was set. However, if we are to reach our overarching long-term goal of achieving ¥1 trillion in net sales, the current plan must achieve at least ¥800 billion in net sales. Accordingly, we intend to augment organic growth with the pursuit of M&As.

Based on wide-ranging discussions, we are presently taking necessary steps to achieve the ¥700 billion target. This involves confirming the current circumstances of each business division and their intentions as well as identifying any shortfalls in resources.

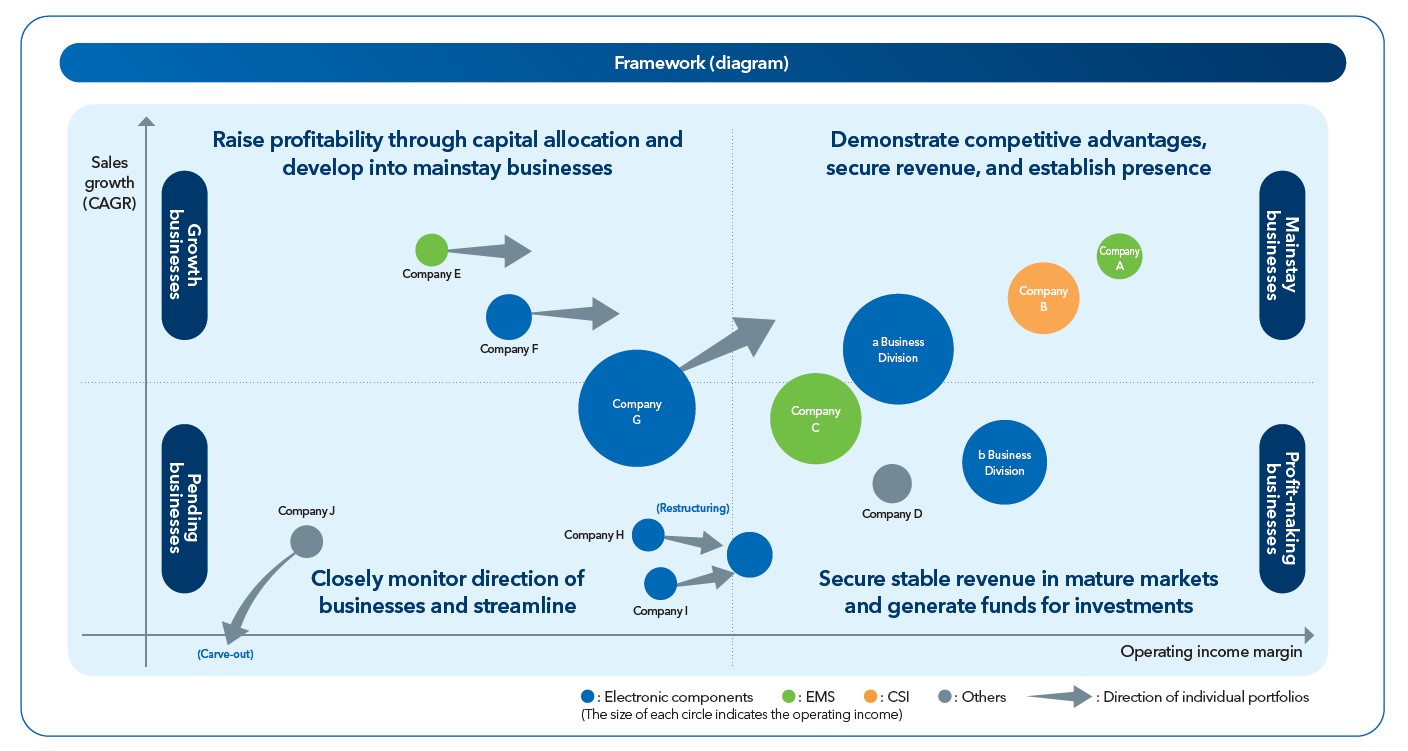

Until now, our business divisions’ intense focus on generating profits had led to a tendency to prioritize business performance. Under the current plan, while reflecting on our business portfolio, we will foster a forward-looking mindset that envisions ideal business performance and evaluates business investments and M&As from the perspective of capital costs and effective use of capital.

While our net cash position was significantly stronger than that of our peers and we boasted excellent financial stability, we faced challenges in terms of capital efficiency. A lack of opportunities to utilize funds set aside for new M&As under the previous plan has contributed to the situation.

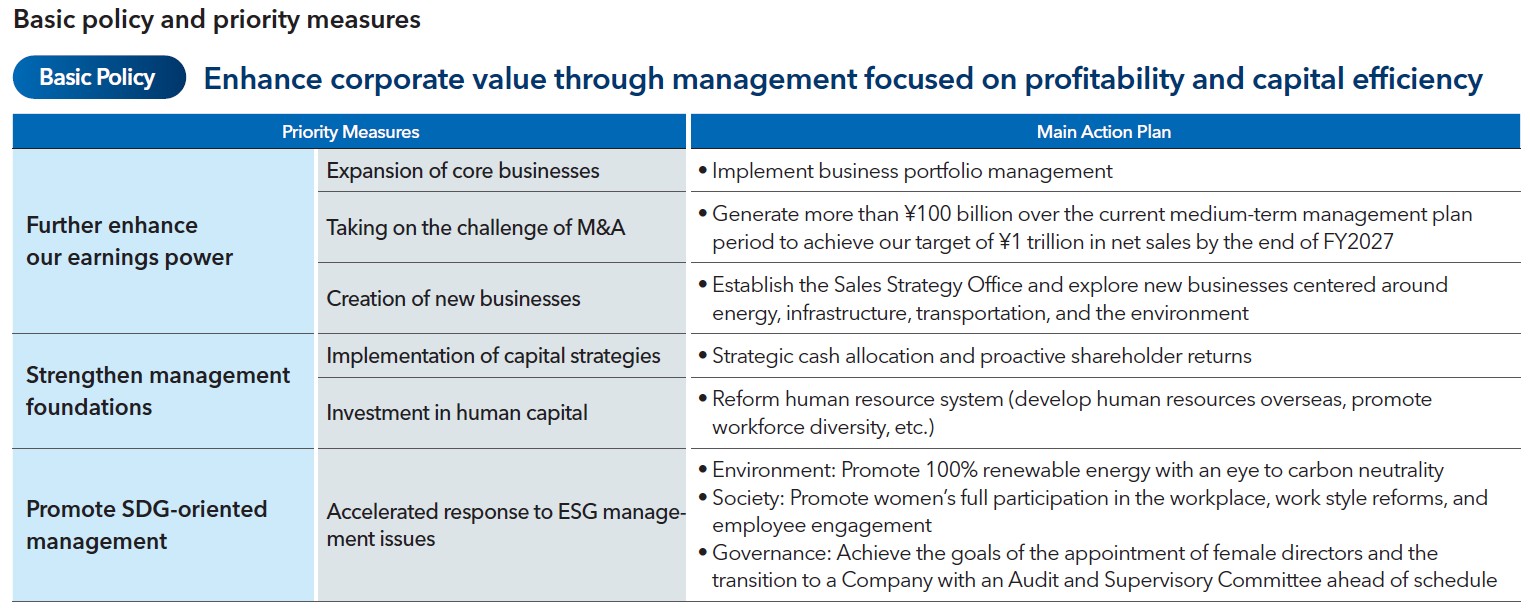

Under the current plan, in line with its basic policy of “enhancing corporate value through management focused on profitability and capital efficiency,” top management will consciously work to shift its mindset and actively pursue improvement in capital efficiency.

That being said, solidifying a business portfolio mindset throughout an entire organization requires a shift in the mindset of those on the front lines.

At Kaga Electronics, the smallest organizational units are sections, which combine to form departments and, ultimately, business divisions. Our corporate culture encourages each section to listen to customer needs and pursuing business with efficiency in mind. The Company’s strength lies in its ability to achieve stable business performance and is largely attributable to the breadth of its coverage, which significantly outstrips that of its competitors. This leaves us much less susceptible to fluctuations in individual industries.

When we started our journey as an independent trading company, we had “nothing to sell” and so began by prioritizing listening to our customers and paying attention to their needs. This principle was eventually enshrined as our corporate philosophy, “Everything we do is for the customers,” and is put into practice every day through KAGA-ism, our management and sales mindset. Consequently, our overwhelmingly strong sales capabilities—reflecting a focus on “having something to sell and knowing where to sell it”—remain our greatest strength to this day, setting us apart from manufacturer-affiliated trading companies.

It is generally thought that a strong company is the result of bringing together entities that are already quite strong. However, for a long time we more resembled a collection of individual shops. This lack of common structure made it difficult to work as a unified organization implementing major policies and strategies. Therefore, in April 2023 we established the Sales Strategy Department as a cross-functional organization focused on market priorities.

In addition, we introduced a sales force automation (SFA) system and are actively promoting the adoption of frameworks to enhance information sharing.

Directly hearing from the customers about the issues they face is undoubtedly the best course of action, meaning that we must continue to further sharpen our customer engagement skills. We must also continue to build mutually beneficial relationships with both our customers and suppliers or we run the risk of becoming obsolete.

In today’s world of rapidly advancing AI, it is not enough to simply provide answers to the issues our customers face. The key to staying ahead of the times lies in unearthing the Group’s wealth of “raw knowledge”—information that cannot be found online—and mastering how to organize, analyze, and impart it effectively. In doing so, we aim to gain a competitive advantage over our peers and become an even more overwhelmingly vital point of contact for our customers.

On top of a corporate culture in which each organization possesses its own strengths, we are working to enhance our digital marketing efforts, leveraging this “raw information” as an additional weapon.

Medium-Term Management Plan 2027 identifies further enhancing our earnings power through the expansion of our core businesses as a priority measure and the implementation of business portfolio management as an action plan.

As an organization within the Kaga Electronics Group, Kaga Electronics analyzes the medium-to-long-term direction of each of its businesses by Visualizing them on a Framework with sales growth potential on the vertical axis and operating income margin on the horizontal axis. This analysis is conducted at the business division level for Kaga Electronics and at the individual company level for Group companies and used to inform investment policies and budget/performance management. While each company previously operated under independent managements, the increase in Group companies through M&A has led to a shift toward managing and allocating management resources with an eye to an overall optimization.

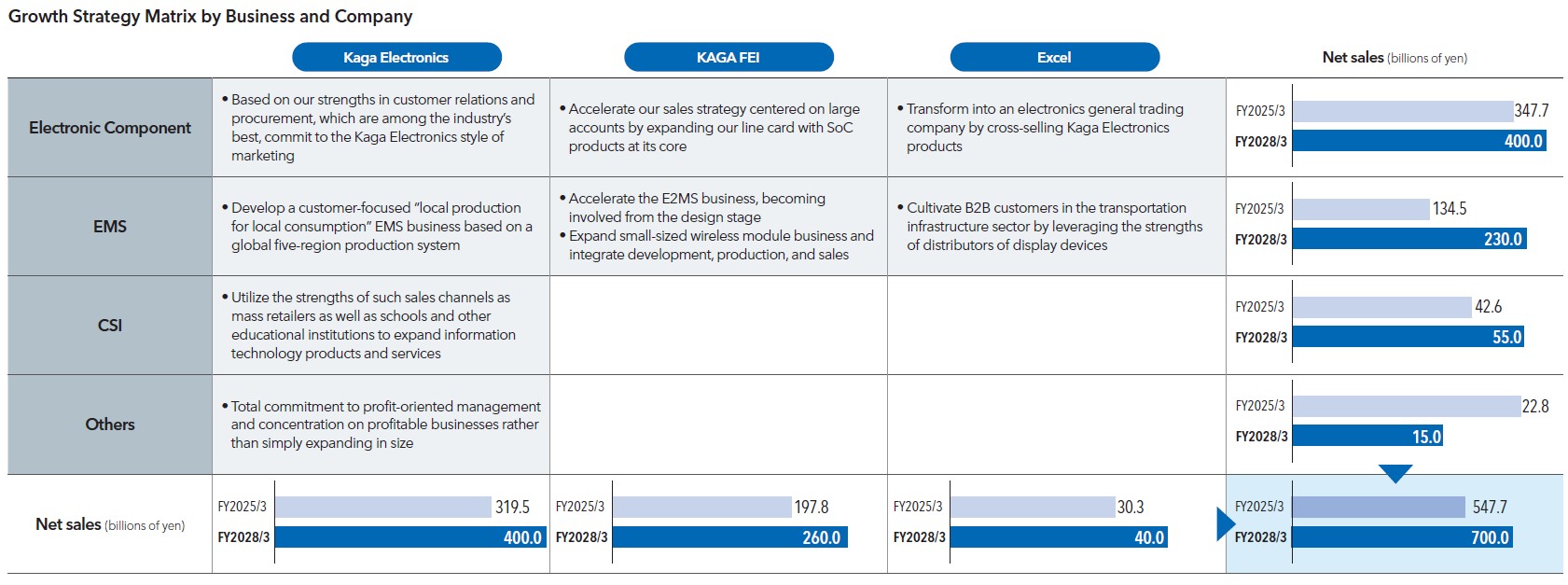

We will continue to pursue scale expansion in the electronic components business through the acquisition of competitors and management integration.

In our EMS business, which we position as a growth driver for the Company, we aim to outpace our competitors in terms of growth, as demonstrated by the compound annual growth rate (CAGR) target set in the medium-term management plan. Customers who previously handled all manufacturing in-house are increasingly turning to outsourcing for some or all of their operations. We expect to achieve high growth in the EMS business by effectively capitalizing on this trend.

In pursuit of further growth in the EMS business, we have determined it is best to target development in the upstream stages of our customers’ value chains. Naturally, the hurdles are high and risks must be considered, but we must also consider the added value gained against the potential risks. The ultimate goal of the EMS business, to sell components, remains unchanged.

Our EMS business adds value by its very nature and even as we strive to take advantage of this, we also nurture high expectations for operations involving the small wireless modules acquired through the business transfer of KAGA FEI. Centered on Bluetooth and Wi-Fi modules, we are leveraging KAGA FEI’s development team in support of initiatives aimed at securing customers’ use of our modules in their finished products.

In taking on the challenge of M&As, another priority measure, we are targeting companies in the electronic components and semiconductor trading sector that are proactively seeking industry consolidation and have a minimum net sales threshold of about ¥20 billion to ¥30 billion. Trading companies affiliated with manufacturers like Kyoei Sangyo, a recent addition to the Group, are seeking new opportunities by partnering with independent trading companies like us. By collaborating with such companies, we hope to advance the consolidation of the industry.

Under the priority measure of creating new businesses, we have established four key themes: energy, infrastructure, transportation, and the environment. We believe the most effective approach to addressing each theme is to target such social issues as population decline and labor shortages as well as the promotion of DX. From there, we will determine the best way to leverage the Group’s assets, which include strengths in the field of electronic components and semiconductors and those of our EMS capabilities particularly suited to monozukuri, or manufacturing. We plan to leverage the Group’s strong customer base and collaborate with well-suited companies to launch new businesses. The aforementioned Sales Strategy Office is spearheading these efforts.

Our investments in human capital focus on developing our core human resources and increasing our overall number of employees. As a means of motivating our core human resources, we believe it crucial to clearly distinguish which individuals will be expected to serve as leaders for the next generation and provide them with targets to aim for as well as proper training, all the while ensuring that their progress is appropriately evaluated so that they will desire to remain in their roles.

Even from my own experience of being transferred without knowing the first thing about corporate planning, I can say that experiencing various departments and unexpected transfers becomes an opportunity for self-improvement. I believe that human resources expected to thrive in the future should be transferred frequently and given the opportunity to gain diverse experience.

As the weight of overseas operations continues to increase, we must urgently address the current severe shortage of overseas personnel nationals among our human resources. We must not only expand the pool of employees within the company who wish to work overseas but step up efforts to recruit experienced professionals from outside the company.

The labor shortage has led to ineffective rotation systems, resulting in a persistent pattern of outbound-only transfers without any transfers into Japan. This situation inevitably reduces the number of employees willing to volunteer for overseas assignments. Therefore, we recognize that nurturing valuable human resources overseas is a pressing issue.

Our employees at the company are all energetic go-getters who are given the freedom to take on any task and speak their minds. Chairman Tsukamoto, though the founder, is always humble and respectful toward everyone. It is precisely this quality that has allowed him to build such a broad network of connections from the Company’s founding to the present day. President Kado, on the other hand, may be demanding when it comes to work but he genuinely cares for his employees.

Through our dedicated efforts, we are committed to further enhancing the Company’s strengths—its free-spirited corporate culture and the exemplary leadership at the top.