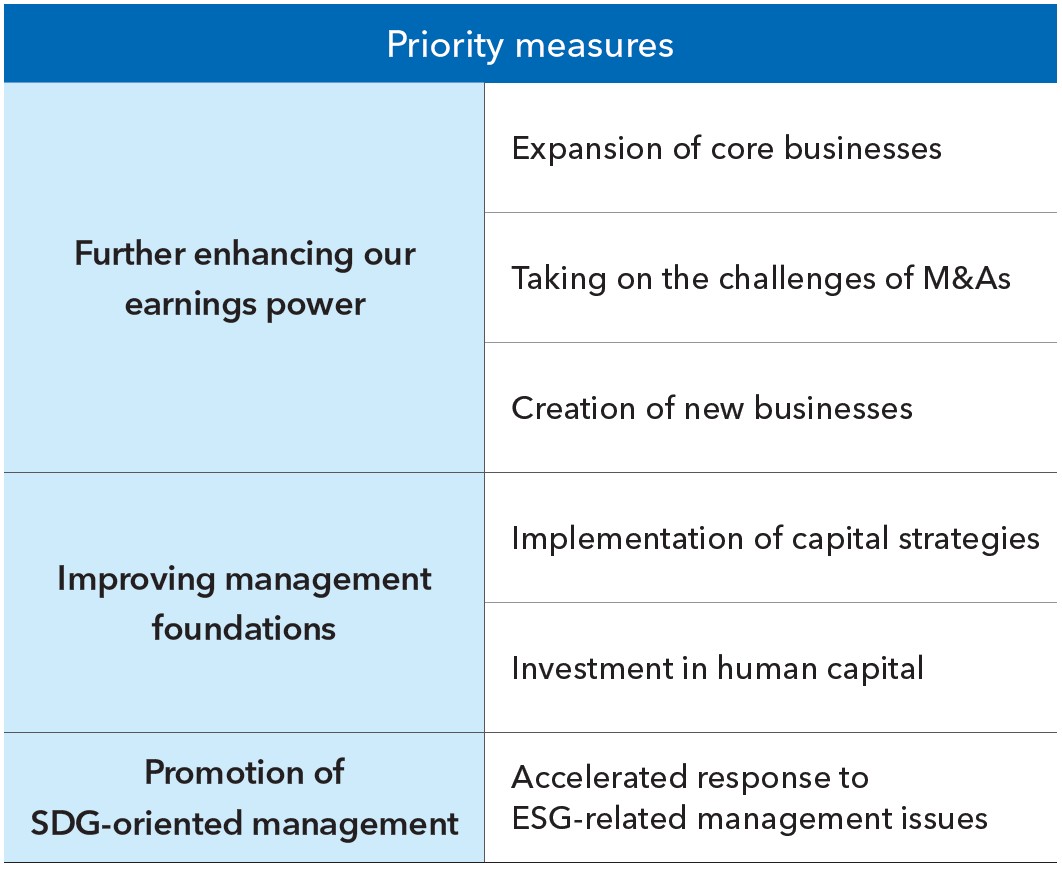

One of the priority measures under Medium-Term Management 2027 (hereinafter “the new plan”), “strengthening management foundations,” places particular emphasis on capital strategy and clearly outlines our approach to strategic cash allocation and proactive shareholder returns.

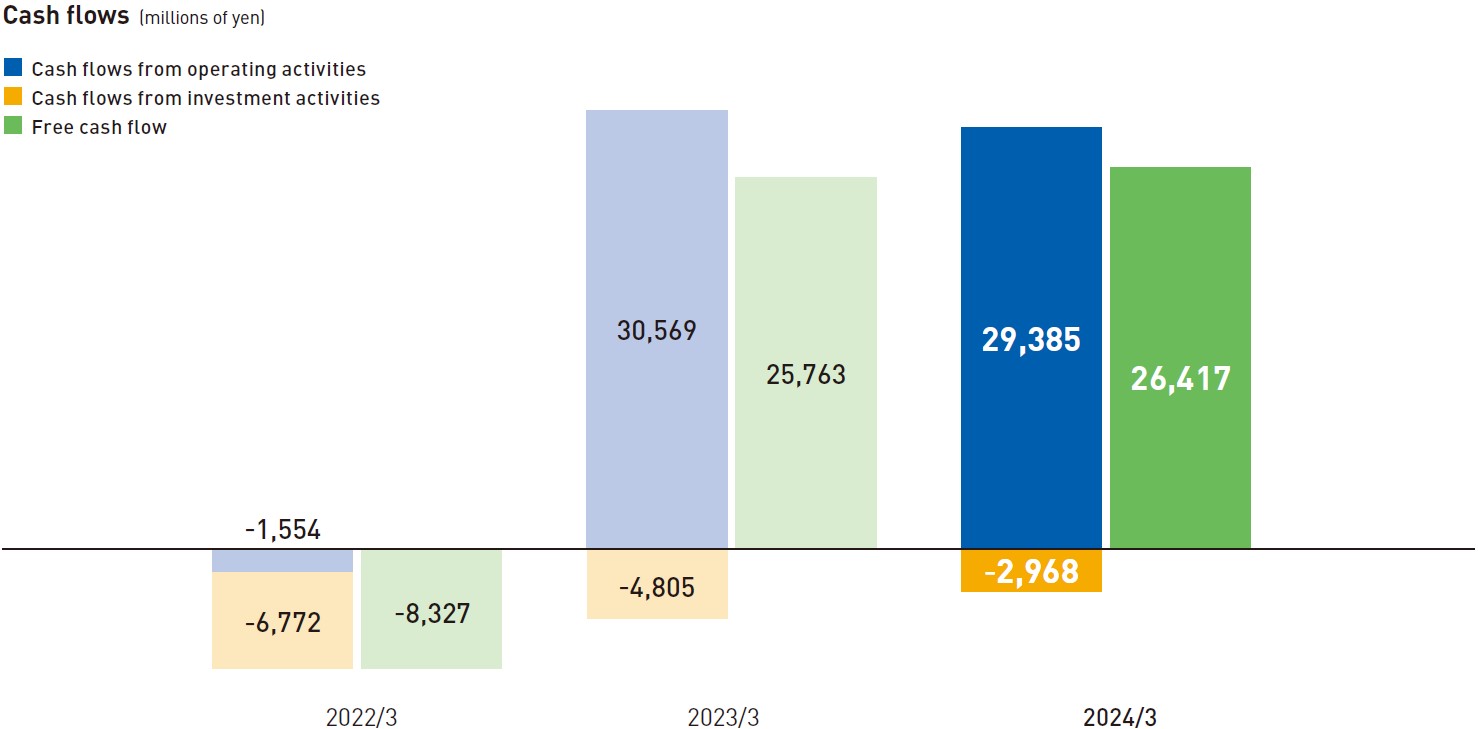

Our method of strategic cash allocation defines how cash generated from operating activities will be allocated and specifies where and how as well as how much will be used. Estimates regarding said allocation over the new plan’s three-year period, include approximately ¥60 billion to be supplied as cash flow from operating activities. Of this, we aim to allocate approximately ¥30 to ¥35 billion toward growth investments and approximately ¥22 to ¥30 billion to shareholder returns.

We will actively pursue new M&A as a key use of growth investments. Kyoei Sangyo, which joined the Group in July 2025, is a prime example of this strategy. Despite our best efforts under the previous medium-term management plan, no suitable M&A opportunities arose, leading to accumulated cash reserves. Therefore, under the new plan, we intend to step up our pursuit of this initiative.

A second use of growth investment will be to expand EMS production capacity. With overseas markets as the primary focus, the EMS business has actively expanded its production bases since 2000. As some of this equipment has deteriorated or become superannuated over the years, we will upgrade to the latest equipment featuring automation and other labor-saving considerations to enhance production efficiency, reduce costs, and further enhance our earnings power.

We will also advance DX initiatives that strengthen our management foundations and make direct investments. While Kaga Electronics has already completed the upgrade of its core SAP system, such upgrades are currently being implemented at domestic Group companies. Through such efforts, we will build a robust DX foundation that unify systems across the Group and advance IT investments.

Lastly, we will unwaveringly continue to invest in human capital, our greatest asset as a trading company. This includes providing benefits to our employees.

Should the cash earmarked for allocation to these growth investments prove insufficient, we will cover the shortfall through borrowings or other means. Conversely, any surplus will be directed toward shareholder returns. In this way, we are approaching cash allocation strategically and flexibly.

Investor RelationsInvestor Relations

Investor RelationsInvestor Relations

- IR

- IR Library

- Integrated Report (Message from the CFO)

Integrated Report (Message from the CFO)

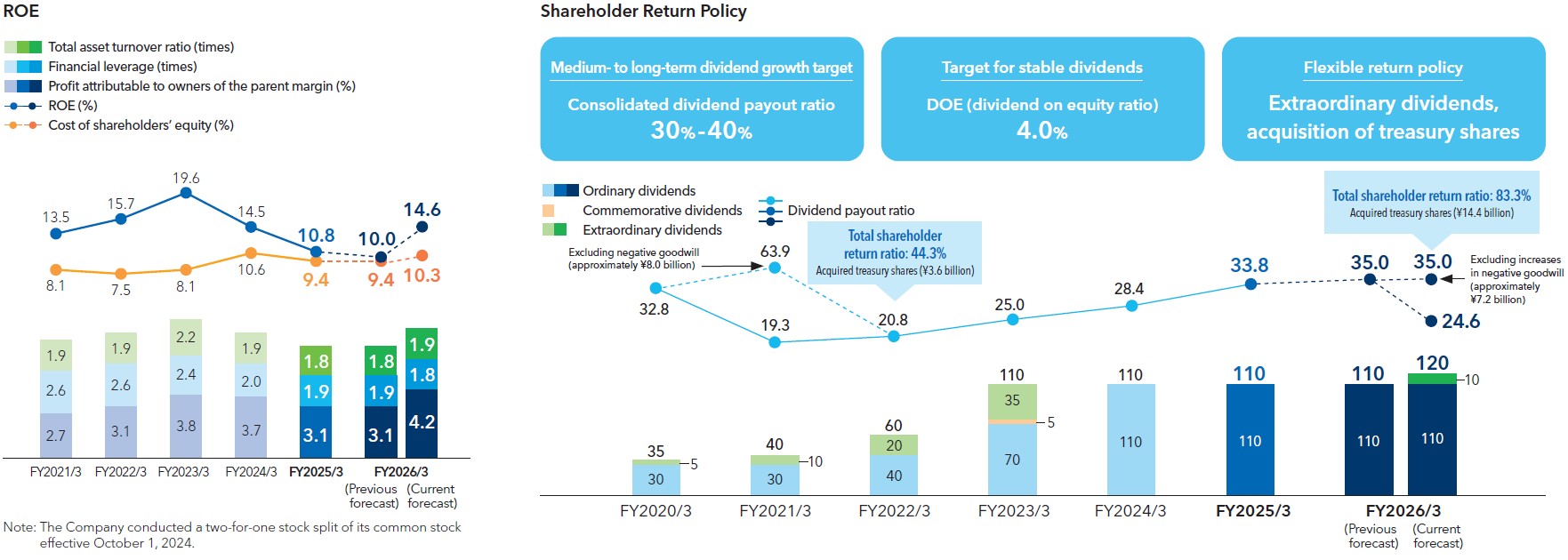

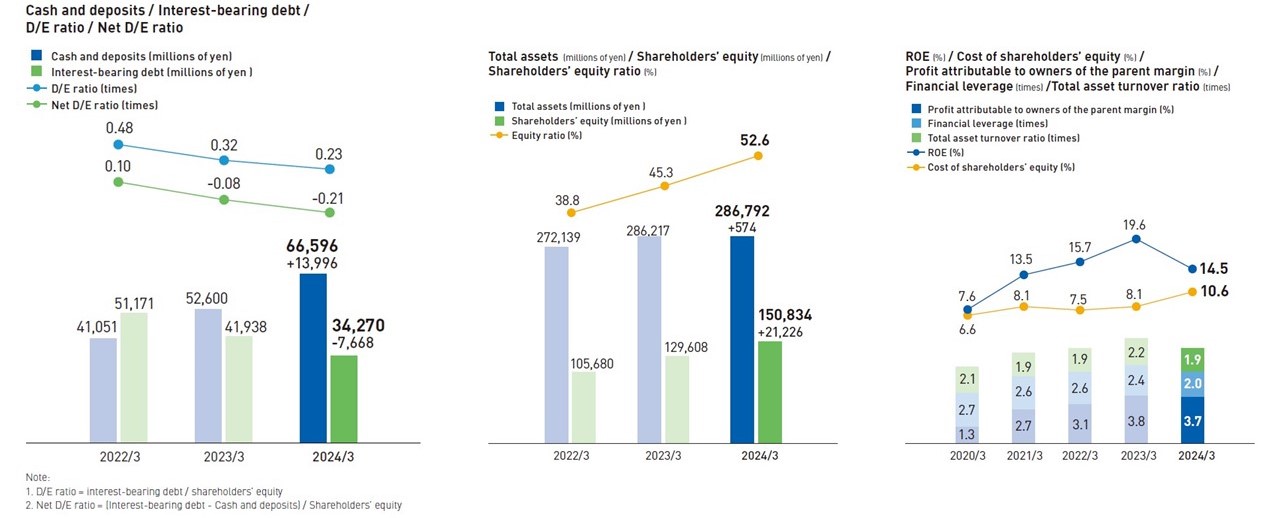

We recognize that expectations regarding our rate of return are rising among both current and prospective investors, shareholders, and potential investors. From the Company’s perspective, we recognize this as the cost of equity capital, which we currently estimate to be around 10%. Therefore, we must achieve a rate of return exceeding 10% while also consistently delivering shareholder returns commensurate with this level. The new plan envisions a growth spiral in which we meet shareholder expectations and this, in turn, drives up our stock price. Our cash allocation policy also aligns with this approach.

The consolidated dividend payout ratio, which serves as a benchmark for medium- to long-term dividend growth, has been raised one notch from the previous medium-term management plan’s range of “25% to 35%” to “30% to 40%” in the new plan.

Furthermore, we have newly established a 4.0% dividend on equity ratio (DOE) as an indicator of stable dividends, and promise consistent payouts regardless of income statement results. Particularly in recent years, significant fluctuations in the supply and demand for electronic components and semiconductors have created a situation that yields substantial profit growth in times of shortage. Conversely, when shortages ease and the balance of supply and demand becomes more relaxed, customer inventory levels increase and our profits tend to stagnate. In other words, due to the very nature of the market, fluctuations in financial results from year to year contribute to unevenness in the Company’s performance. Therefore, as relying solely on the consolidated dividend payout ratio would result in unstable dividends, we have decided to introduce DOE to ensure investors can invest with confidence.

The Company has traditionally returned surplus earnings by supplementing ordinary dividends with extraordinary dividends when management targets are exceeded, and it intends to continue this flexible return policy.

Share buybacks are another example of the flexibility of our shareholder return policy. On August 8, 2025, we conducted our largest-ever share buyback, totaling ¥14,447 million, through the Tokyo Stock Exchange’s off-auction share repurchase system (ToSTNeT-3). The cancellation of all such treasury shares represents 9.4% of the total number of our shares outstanding (excluding treasury shares). This marks the first time the Company has cancelled treasury shares since its initial public offering.

Amid the recent trend of reducing and eliminating strategic shareholdings, our four primary banks expressed an intention to sell their holdings of our shares. We decided to repurchase these shares in consideration of the impact it would have on our stock price.

The Company revised its full-year earnings forecast for the fiscal year ending March 2026 from a decline in both sales and profit to an increase, reflecting the effect of the Kyoei Sangyo acquisition, and announced a forecast for a dividend increase.

Following the dividend increase revision, DOE is projected to be 4.2%. With this share buyback and cancellation, ROE for the fiscal year ending March 2026 is expected to reach 14.6%, and the total dividend payout ratio is projected to be 83.3%. The stock market has responded favorably to the Company’s initiatives, with PBR exceeding 1.1 times (as of September 30, 2026).

Going forward, we will continue to steadily implement our new medium-term management plan and strive to enhance corporate value.

To maintain ROE above the cost of capital, improving profitability is an absolute priority. This requires relentlessly pursuing profit by compressing costs as much as possible. President Kado has consistently emphasized this approach since taking office and has implemented various initiatives to enhance our earnings power. At the same time, we have worked to improve asset efficiency—looking to generate sales and earn profits while amassing minimal assets.

Since its founding, Kaga Electronics has adhered to the principle of “asset-light management.” Within its sales divisions, it rigorously enforces the philosophy that “inventory is a liability,” striving to minimize stockpiles as much as possible. Similarly, it has prioritized collections over payments, compressing accounts receivable and avoiding long-term collections.

In terms of minimizing idle capital, we adhere to the principle of investing in noncurrent assets only when truly necessary while avoiding holding noncurrent assets that do not generate profits. This approach is not only in line with our policy regarding capital efficiency but reflects current requirements.

In managing financial leverage, we prioritize exceeding our shareholders’ expected rate of return while maintaining a balanced approach to ensure our funding capacity remains intact. We hold an A (single A flat) credit rating and, although we have not undertaken any major investment projects during the current medium-term management plan period and maintain ample cash reserves, we remain acutely mindful of financial discipline. We will carefully select investment targets, applying both the accelerator and the brakes as needed.

“Inventory is a liability,” “Prioritize collections over payments,” “Don’t let money sit idle”—without a doubt, the principles of KAGA-ism that have been cherished by Chairman Tsukamoto since our founding and instilled in all of our employees have served to strengthen the Group’s financial foundations. By avoiding the buildup of unnecessary inventory, this approach has also prevented losses due to dead stock and the creation of bad debt.

Kaga Electronics has implemented a system of individual inventory management that links particular lots of inventory to individual salespeople. This approach embeds the entire process—from product sales to the collection of payment—into the sales role as defined by the Company’s action guidelines. We believe this concept should be adopted universally.

Although inventory levels as of the end of March 2025 had returned to normal levels, we recognize there remains room for further reduction. Given the strong commitment of our sales team to achieving a 1% operating income margin, we expect current efforts to yield results.

In terms of M&A that complements organic growth, with Kyoei Sangyo joining the Group, the new medium-term management plan has gotten off to a promising start. To achieve net sales of ¥1 trillion, we must continue to pursue M&A as the second and third arrows in our quiver.

As the person responsible for our finances, I am prepared to handle any project that arises at any time and am ready to invest funds without hesitation when necessary.

Please choose whether to accept or opt out of cookies.