In the fiscal year ended March 31, 2025, net sales increased 0.9% year on year to ¥547,779 million. While the electronic components and information equipment businesses experienced sluggish growth due to prolonged inventory adjustments and the conclusion of transactions with a certain major customer, the software and other businesses performed steadily.

Over the same period, operating income fell 8.7% year on year to ¥23,601 million due to increased selling, general and administrative expenses brought about by a wage increase and rising logistics costs. Also, due to a decrease in gain on sales of investment securities (¥1,420 million) in the previous year, profit attributable to owners of the parent fell 16.0% year on year to ¥17,083 million.

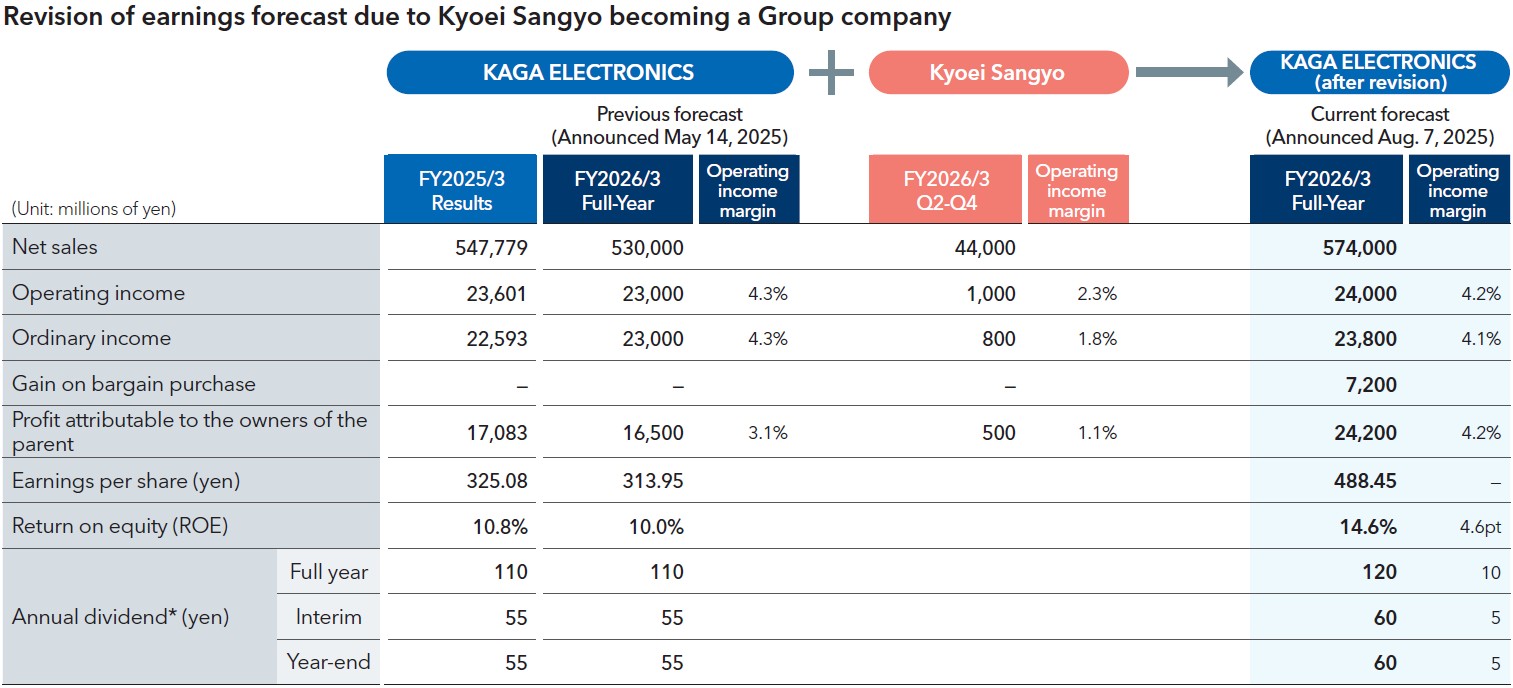

For the fiscal year ending March 31, 2026, we initially projected a decline in both net sales and profits, factoring in inventory adjustments alongside the impact of yen appreciation and U.S. tariff policies. However, with the consolidation of Kyoei Sangyo Co., Ltd. into the Group as of August 7, 2025, we are able to project net sales of ¥574.0 billion (up 4.8% year on year), operating income of ¥24.0 billion (up 1.7% year on year), and profit attributable to owners of parent of ¥24.2 billion (up 41.7% year on year), due to the recognition of ¥7.2 billion in negative goodwill associated with the acquisition. Our forecast has thus shifted to one of increased revenue and profit, while also being revised upward to include an increase in both revenue and profit.

Investor RelationsInvestor Relations

Investor RelationsInvestor Relations

- IR

- IR Library

- Integrated Report (Message from the COO)

Integrated Report (Message from the COO)

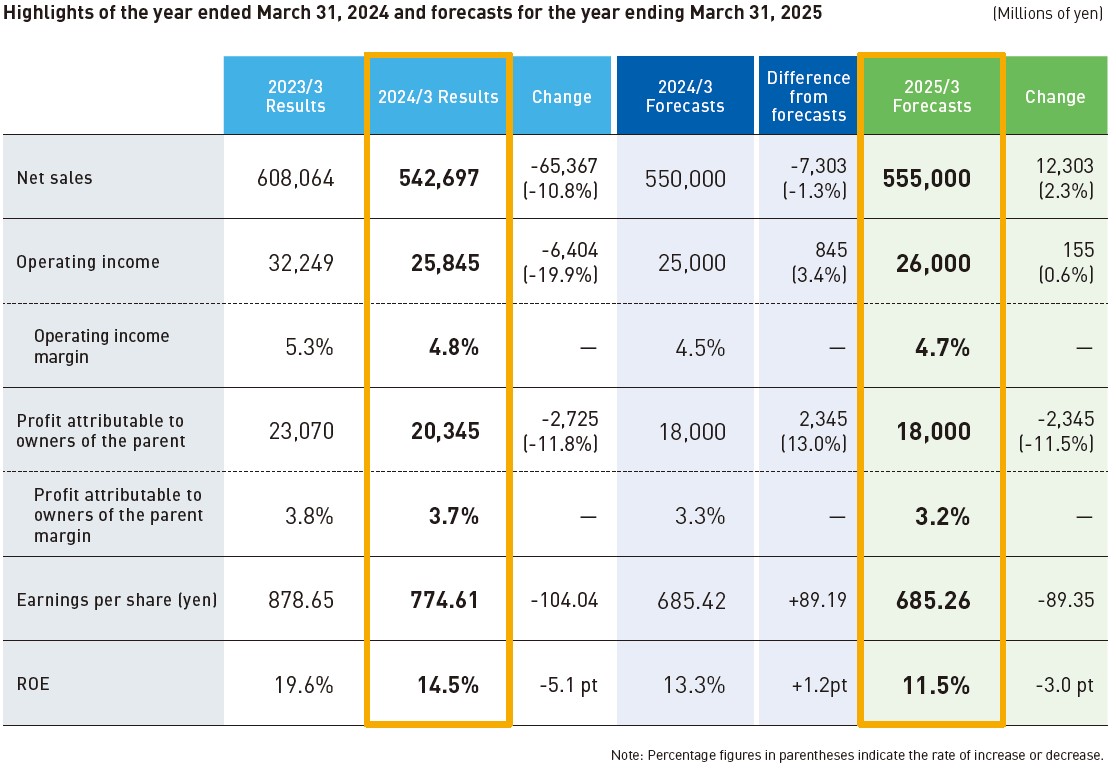

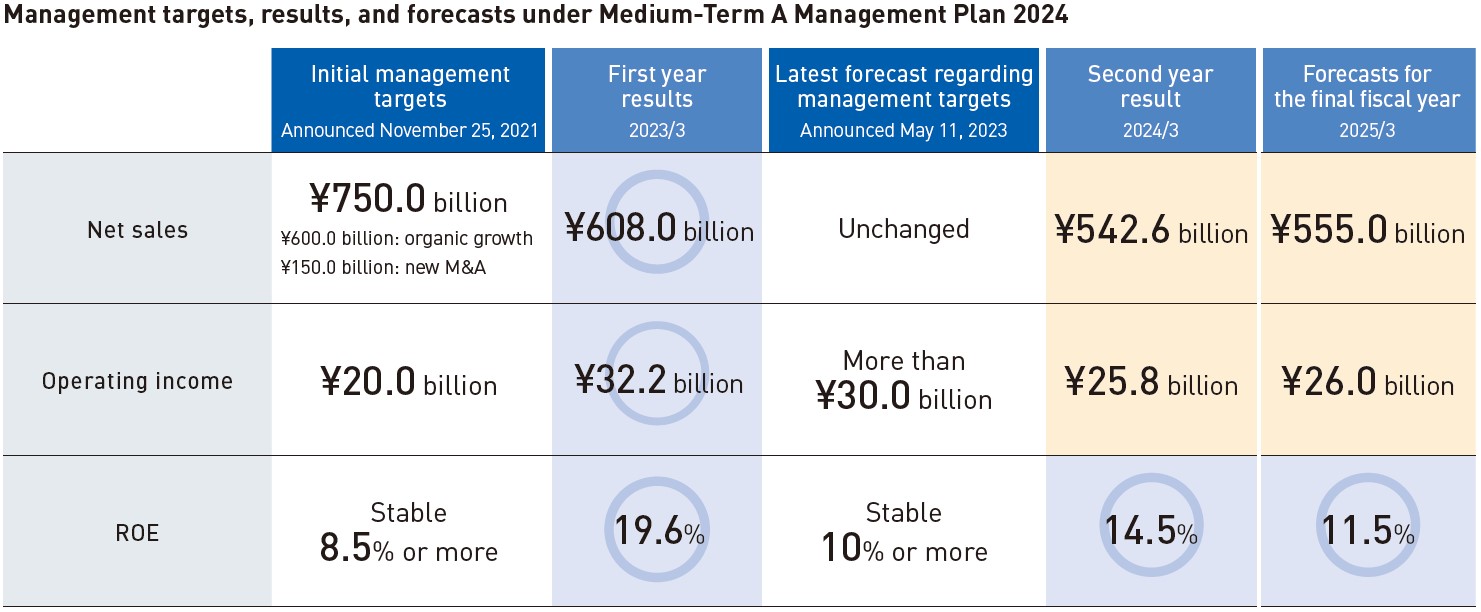

In quantitative terms, the core electronic components business had a solid performance during the plan’s first year (ended March 2023), meeting KPI targets despite tight supply and demand conditions for semiconductors and electronic components. As a result, excluding new M&A targets, all KPIs—net sales, operating income, and ROE—were achieved two years ahead of schedule.

Building on this strong start, in May 2023, we announced a revised performance forecast for the plan’s final fiscal year.

However, due to the effects of prolonged inventory adjustments and a wage increase, neither of which were anticipated at the time of the revision, both net sales and operating income for the fiscal year ended March 2025, the plan’s final year, fell short of the revised numbers. However, ROE remained stable at over 10% throughout the medium-term management plan period.

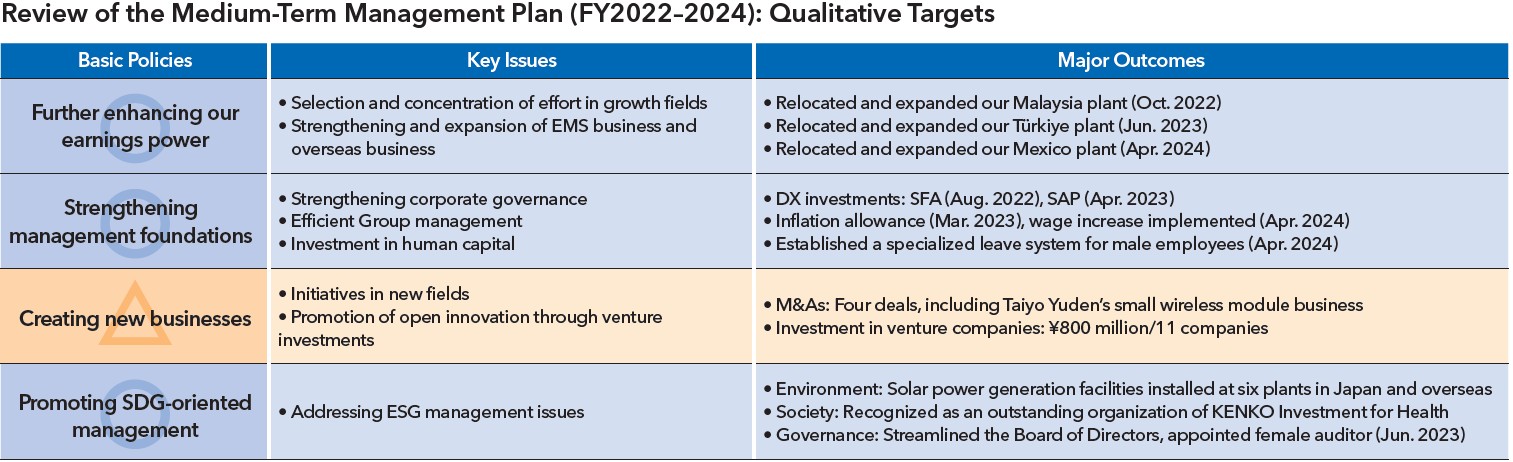

On the qualitative front, we implemented various management initiatives in line with our basic policies to “further enhance our earnings power,”“strengthen management foundations,”“create new businesses,”and“promote SDG-oriented management.”

Regarding efforts to further enhance our earnings power, we have been working to increase the production capacity of our factories in Malaysia, Turkey, and Mexico with the aim ofstrengthening our EMS business.

To strengthen management foundations, we promoted DX in management through such initiatives as replacing the core system and introducing sales force automation (SFA) tools. We also invested in human capital by implementing nflation allowances and a wage increase in addition to establishing a new specialized childcare leave system for male employees.

In our efforts toward promoting SDG-oriented management, we proactively addressed issues across the Environmental, Social, and Governance (ESG) dimensions. Specifically, regarding Governance (G), at the June 2023 General Meeting of Shareholders, we streamlined the Board of Directors, reducing its membership to six individuals, including three outside directors, and appointed a female auditor.

However, with regard to new business creation, although we continued to carry out small-scale business transfers and investments in venture companies, we were not able to achieve the plan’s quantitative M&A targets. We have resolved to accelerate efforts in this area under our new Medium-Term Management Plan 2027.

The overarching purpose of Medium-Term Management Plan 2027 (hereinafter, “the plan”) is to strive toward the management vision established under the previous medium-term management plan, namely, to achieve annual net sales of ¥1 trillion and establish KAGA ELECTRONICS as a competitive world-class company and the Japanese industry’s No. 1 corporate group in conjunction with its 60th anniversary; the fiscal year ending March 31, 2029 (FY2028).

The plan establishes enhancing corporate value through management focused on profitability and capital efficiency as its basic policy and will implement the following three priority measures.

1. We will further enhance our earnings power by focusing on expanding our core businesses, taking on the challenge of M&A, and creating new businesses.

2. We will improve our management foundations by clarifying our approach to allocating cash in line with strategic capital policies (see next section for further details) and revise our policy on shareholder returns.

3. We will promote SDG-oriented management by accelerating our response to ESG-related management issues in accordance with our Medium-to-Long-Term Sustainability Management Plan formulated in November 2021.

With an eye to achieving ¥1 trillion in net sales in FY2028, we have set management targets for the plan’s final year (FY2027): net sales of ¥800 billion or higher and operating income of ¥36 billion or higher. As subsets of these targets, we have set target values for organic growth—¥700 billion or higher in net sales and ¥35 billion or higher in operating income—along with securing an operating income margin of 5.0%.

As capital efficiency is the principal emphasis of the plan’s basic policy, we have set the final-year target for ROE at 12.0% or higher, with an awareness that the current cost of shareholders equity is around 10%.

Although the business environment remains unpredictable, we are determined to achieve the plan’s targets at all costs.

Our basic approach to cash allocation is to maintain financial discipline while prioritizing the allocation of generated cash toward growth investments and shareholder returns with the aim of enhancing corporate value.

Specifically, we estimate that operating activities will generate a cash flow of ¥60 billion over the three-year plan period. Of this, we intend to allocate around ¥22 billion to ¥30 billion to shareholder returns, and over ¥30 billion toward growth investments such as new M&As and increasing production capacity in the EMS business.

The amount of funding needed for an M&A deal can vary significantly. Therefore, we will flexibly address any shortfall through external borrowing, etc. At the same time, if cash flow shows a surplus, we will allocate said surplus to shareholder returns. Our policy is to fully utilize all cash generated during the plan’s period.

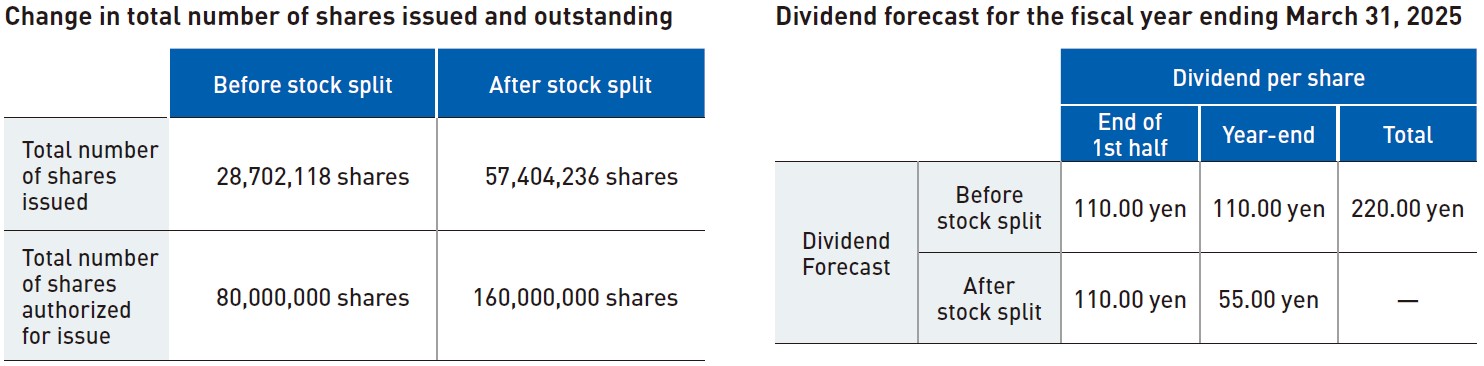

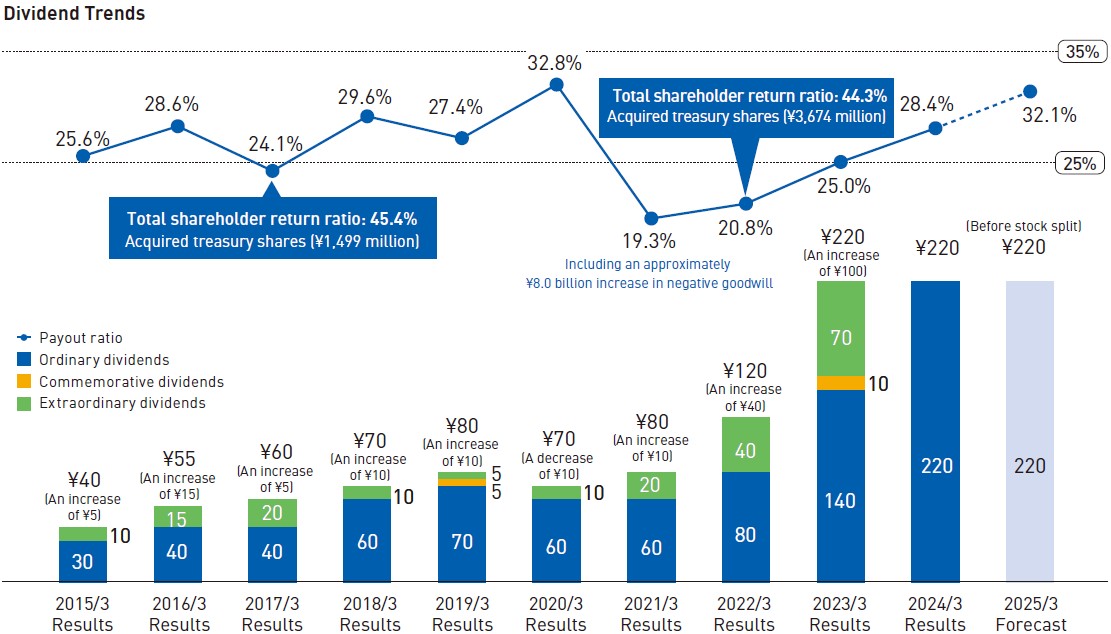

Under the plan, we significantly revised our previous shareholder return policy with a view to more proactively returning profits to our shareholders.

First, we raised our target consolidated dividend payout ratio from the previous range of 25%-35% to 30%-40%, aiming for dividend growth through medium-to long-term earnings growth.

Next, with the goal of securing stable and continuous dividends, we have adopted the dividend on equity ratio (DOE) as a new metric and are targeting a rate of 4%.

Finally, we will flexibly implement extraordinary dividends and the purchase of treasury shares as measures aligned with profit level and capital efficiency goals.

In accordance with this policy, in August 2025, the Company repurchased all of the common shares held by its four transaction banks, which are shareholders of the Company, through the Tokyo Stock Exchange’s off-auction treasury share repurchase system (ToSTNeT-3). The total acquisition cost was ¥14.4 billion, and the 4,917,400 common shares acquired represent 9.4% of the total number of shares issued. All acquired shares have been canceled.

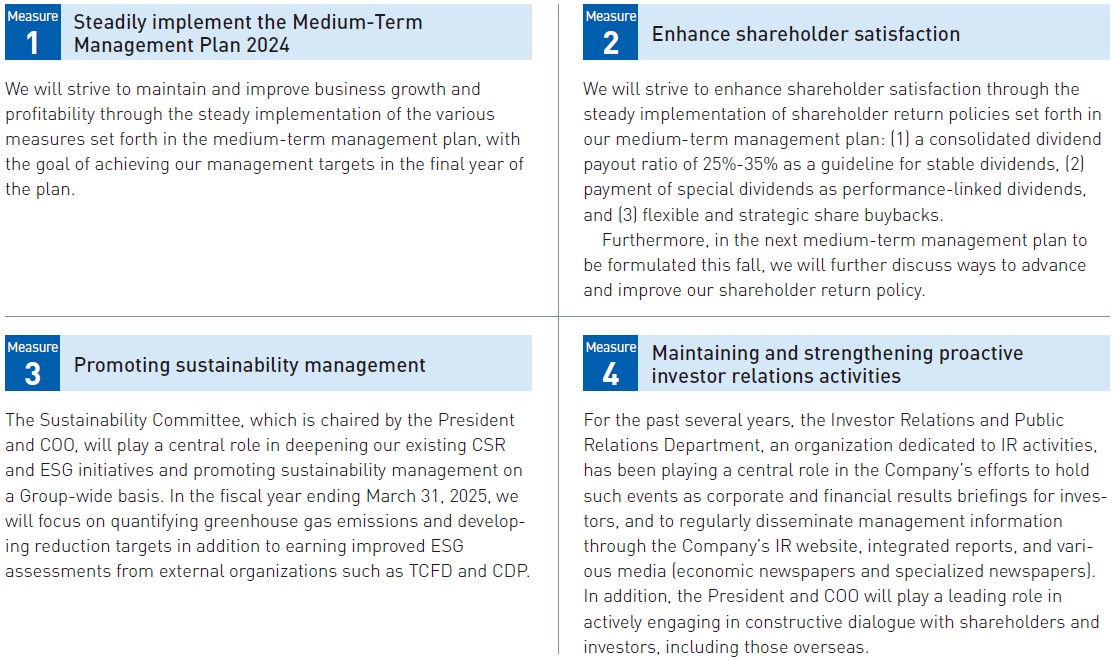

In our efforts to improve the price-to-book ratio and secure fair stock market evaluations of our business initiatives and growth strategies as well as to continue improving ROE by achieving profitability in excess of the cost of shareholders’ equity, we will steadily implement the various measures set forth in our Medium-Term Management Plan 2027 with a focus on the following four initiatives. Furthermore, we will continue to strive for constructive dialogue with market participants through proactive investor relation activities.

We will continue to strive for proactive and constructive dialogue to ensure fair evaluations from the stock market regarding our business initiatives.

As outlined in the previous section, the new medium-term management plan positions the growth and expansion of such existing businesses as the electronic components business and EMS business alongside M&As and the expansion of partnerships as the two pillars of its growth strategy.

As part of this strategy, in July 2025, the Company successfully submitted a tender offer bid for the common stock of Kyoei Sangyo, a specialized trading company dealing in electronic components, semiconductors, industrial equipment, and other products. Kyoei Sangyo is a mid-sized trading company in the industry with annual net sales of ¥57.7 billion and profits of ¥1.7 billion (fiscal year ended March 2025). It is scheduled to become a wholly owned subsidiary within the year. To reflect Kyoei Sangyo joining the Group, the full-year performance forecast for the fiscal year ending March 2026 was revised upward with the initial projection of decreased net sales and profits transforming into a forecast of increased net sales and profits. Concurrently, an upward revision in the dividend forecast was announced.

Although the new medium-term management plan has just commenced, we intend to continue proactively pursuing M&A opportunities.

* The Company conducted a two-for-one stock split of its common stock effective October 1, 2024. The amounts indicated above related to dividends paid for the periods prior to October 1, 2024, are adjusted for the said stock split.

Please choose whether to accept or opt out of cookies.